News

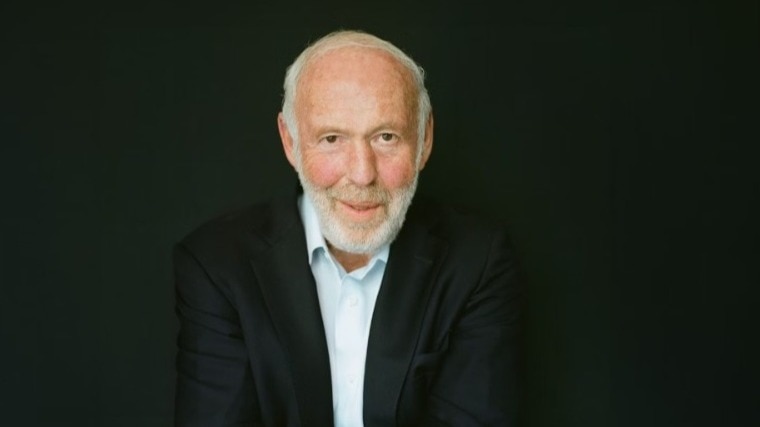

Jim Simons, the Cold War code-breaker who built the world’s greatest moneymaking machine

Jim Simons, the person who many buyers imagine constructed the world’s best moneymaking machine at his secretive agency, Renaissance Applied sciences, has died.

He was 86.

A one-time code breaker for the US authorities, Simons by no means shared the key of how he made greater than 4 occasions the return of the S&P 500 Index in his most well-known fund, Medallion. From 1988 by 2023, the fund obtained him a mean annual return of just about 40%, even after hefty charges, turning Simons and three of his colleagues into billionaires.

The Quant King

Simon moved from academia to investing in his 40s, eschewing commonplace practices of cash managers in favor of quantitative evaluation, discovering patterns in information that predicted worth adjustments. His success earned him the sobriquet — Quant King.

At Renaissance, situated in East Setauket, New York, Simons prevented using Wall Road veterans. As an alternative he sought out mathematicians and scientists, together with astrophysicists and code breakers, who helped him collect usable funding info within the terabytes of knowledge his agency sucked in every day on every thing from sunspots to abroad climate.

“There are only a few people who’ve really modified how we view the markets,” Theodore Aronson, founding father of AJO Vista, a quantitative cash administration agency, informed Bloomberg Markets journal in 2008. “John Maynard Keynes is among the few. Warren Buffett is among the few. So is Jim Simons.”

He was value an estimated $31.8 billion, making him the Forty ninth-richest individual on the planet, in accordance with the Bloomberg Billionaires Index.

Math wizard

Born on April 25, 1938, within the Boston suburb of Brookline, Simons was the one youngster of Matthew Simons and Marcia Kantor. His father labored within the movie trade as a New England gross sales consultant for twentieth Century Fox. Later he helped handle his father-in-law’s shoe manufacturing unit.

Precocious at math from age 3, Simons accomplished Newton Excessive Faculty in three years. At MIT, he earned a bachelor’s diploma in arithmetic in 1958 after simply three years of examine. Whereas pursuing his Ph.D. on the College of California at Berkeley, he obtained his first style of investing, driving to a Merrill Lynch brokerage in San Francisco to commerce soybean futures.

Chilly Struggle code-breaker

In 1964, after instructing at Harvard College, Simons moved to Princeton, New Jersey, to take a high-paying and extremely labeled job on the Institute for Protection Analyses. The nonprofit analysis group was hiring mathematicians to assist the US Nationwide Safety Company in cracking codes and ciphers utilized by the Soviet Union.

Disclaimer: Enterprise At present supplies inventory market information for informational functions solely and shouldn’t be construed as funding recommendation. Readers are inspired to seek the advice of with a professional monetary advisor earlier than making any funding choices.

-

News3 weeks ago

News3 weeks agoUp Board Class 10th 12th Result 2024 Live Download Upmsp High School Inter Marksheet At Upmsp.edu.in – Amar Ujala Hindi News Live

-

News4 weeks ago

News4 weeks ago‘Chamkila’ movie review: Diljit Dosanjh gamely anchors Imtiaz Ali’s vibrant musical

-

News17 hours ago

News17 hours agoGujarat Board GSEB SSC 10th result date and time: GSEB to announce class 10th results on May 11- check time here – Education News

-

News2 weeks ago

News2 weeks ago‘Remove dictatorship and save democracy’: Top quotes from Sunita Kejriwal’s maiden roadshow for Lok Sabha polls | India News

-

News4 weeks ago

News4 weeks agoRealme P1 5G, Realme P1 Pro 5G launched in India: Price, specs, launch offers and more

-

News3 weeks ago

News3 weeks agoCUET UG 2024: NTA announces schedule, datesheet; exams to begin on THIS date. Check all details here

-

News4 weeks ago

News4 weeks agoRealme P1 and P1 Pro launched in India: Price, sale offers, specifications

-

News3 weeks ago

News3 weeks agoCUET UG 2024 Schedule: NTA CUET datesheet out at exams.nta.ac.in, timetable here | Competitive Exams